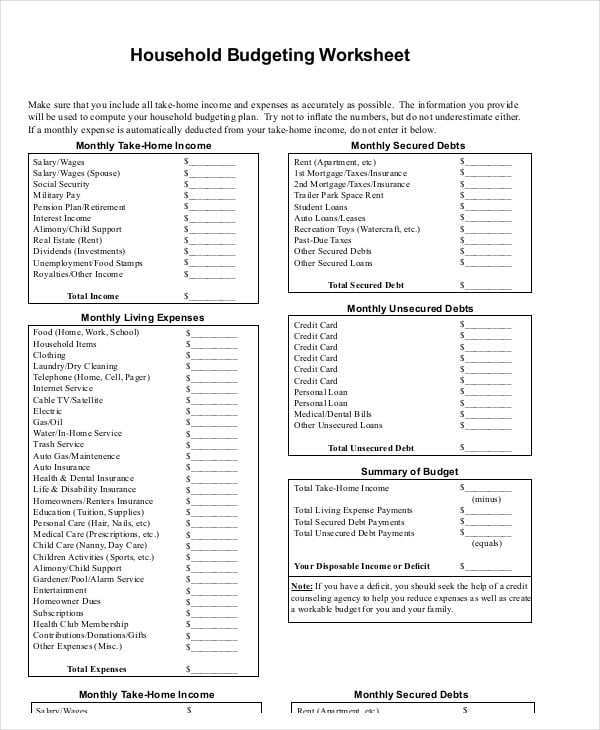

80+ Personal Budget Categories You Don’t Want to Forget.Trust me, there’s always stuff you forget. The slush fund for all the stuff you forgot to budget for. Personal Spending (5-10%)Ĭlothing, haircuts, home decor, and all that stuff you buy at Target when you spend $200 and have no idea what you bought (no, just me?) Miscellaneous (5-10%)

PERSONAL BUDGET ITEMS FREE

For us that would be stuff like Netflix, our gym membership (1.5 hours of free childcare a day might make this our best purchase ever!), and activities for the kids. Recreation (5-10%)Īnything you do for fun. But you also need to consider life insurance, disability insurance, etc. Health insurance just keeps getting more and more expensive. Make sure you’re taking care of yourself and your family. It could be routine doctor visits, or multiple trips to the urgent care clinic over Christmas when you are sick and away from home (that was a rough holiday for our family…) At the end of the day, your health is more important than money. While you can’t really plan for health expenses, it’s good to account for them in your budget. If you’re like most of us, this money goes toward your car payment, gas, and insurance. If you’re lucky enough to live in a big city and not need a car, this could be subway tickets or Uber rides. Transportation (10%)Īnything you need to spend money on to get to work, the store, or your other weekly activities. If you can cut your rent from $1200 to $1000 per month, that’s extra savings of almost $2500 per year – enough to fund a nice vacation! Just remember that owning a home comes with hidden costs you have to remember to budget for such as HVAC replacement, emergency plumbing repairs, etc. This is a big chunk of your budget, and a great place to try to find some savings by living a little cheaper. Your rent or mortgage (including property taxes and insurance). While not specifically mentioned by Dave Ramsey, I would put your cell phone here too.

This includes electricity, water, natural gas, and trash service. If you need some help, here are 7 ways we save money on groceries without sacrificing quality, and here is a detailed breakdown of how much you should spend on groceries. If you don’t plan ahead, it can be easy to spend a lot of money on convenience foods or grabbing take out on the way home from work. This can be one of the hardest categories to for people to budget for, and I know personally we have to keep an eye on it every month so that it doesn’t get out of control. Food (10-15%)ĭave Ramsey’s food budget recommendations include groceries and eating out. Money set aside for the future, whether building up your emergency fund or saving for retirement in a 401(k) or IRA. I 100% agree on this point, and I believe giving is a big part of changing your mindset about money. The cornerstone of Dave Ramsey’s approach to budgeting starts with giving to your church or other charitable causes you care about. Here’s a little more detailed breakdown with what goes in each category according to Dave Ramsey: Giving (10%) Recommended Household Budget Category Descriptions Here is a simple budget percentage pie chart you can use as a guideline for your ideal household budget ( Pin it here): These budget percentages are based on your total after-tax income, but before you take out things like health insurance or 401(k) contributions from your paycheck. If you don’t know where to start with budgeting, here are Dave Ramsey’s recommended household budget percentages and categories that he recommends starting with.

Are the Dave Ramsey Budget Percentages Realistic?.Recommended Household Budget Category Descriptions.

0 kommentar(er)

0 kommentar(er)